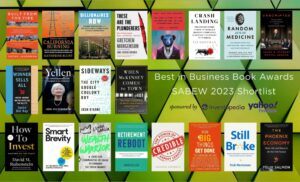

SABEW Unveils 29th annual BIB Awards Recipients

The Society for Advancing Business Editing and Writing (SABEW) announced today the 147 recipients of its 29th annual Best in Business Awards, honoring excellence in business journalism from 2023. The Best in Business … Read more